Semiconductor lithography technology manufacturer ASML (ASML) announced its financial report for the third quarter of 2025. Due to the positive momentum of AI investment and its expansion to customers including cutting-edge logic chips and advanced...

Semiconductor lithography technology manufacturer ASML (ASML) announced its financial report for the third quarter of 2025. Due to the positive momentum of AI investment and its expansion to customers including cutting-edge logic chips and advanced DRAM chips, total revenue in the third quarter reached 7.5 billion euros, with a gross profit margin of 51.6%, consistent with the previous one, reflecting ASML's good performance this quarter.

ASML stated that in the third quarter, net sales (net sales) were 7.5 billion euros, net income (net income) was 2.1 billion euros, gross margin (gross margin) was 51.6%, the order amount in the third quarter was 5.4 billion euros, and 3.6 billion euros were EUV orders. In addition, for the fourth quarter of 2025, net sales are estimated to be approximately 9.2 billion to 9.8 billion euros, and gross profit margin is estimated to be approximately 51% to 53%. The overall net sales in 2025 will increase by 15% compared with 2024, with a gross profit margin of approximately 52%, and the total net sales in 2026 are expected to be no less than in 2025.

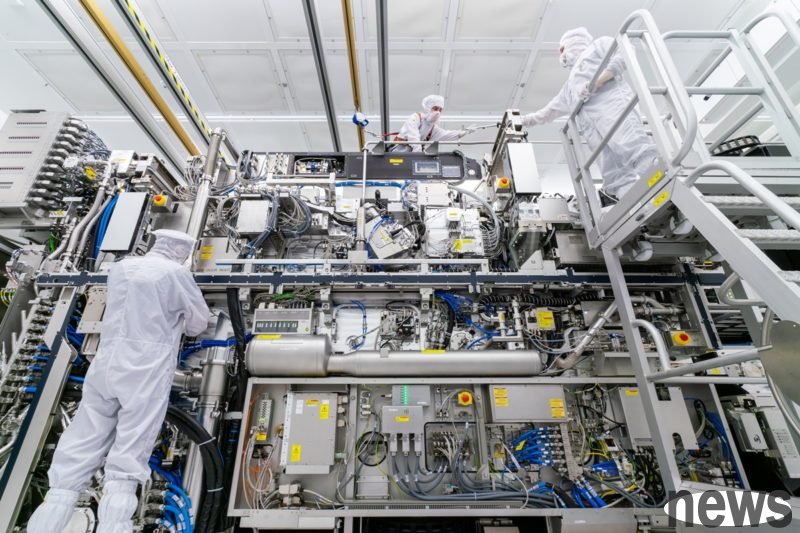

In terms of technology, the acceleration of customer introduction of EUV and the progress of High NA EUV technology have seen the industry’s adoption of lithography processes continue to grow. In order to support customers in the field of 3D integration, ASML's first service advanced packaging product TWINSCAN XT:260 has been delivered. It is an i-line lithography equipment with a productivity four times higher than that of market solutions.

Working with Mistral AI, AI is introduced into the entire product portfolio, improving system performance and productivity, and improving yield.

In terms of the market, the momentum of investment in AI and the expansion of customers for cutting-edge logic chips and advanced DRAM chips also have a positive effect. Customer demand in China will decline, with total net sales in China significantly lower in 2026 than in 2024 and 2025. However, total net sales in 2026 are not expected to be lower than in 2025, and details will be provided in January 2025.

Outlook for the fourth quarter, total net sales are approximately 9.2 billion to 9.8 billion euros, with a gross profit margin of 51%~53%. R&D costs are approximately 1.2 billion euros, and selling and administrative expenses (SG&A) are approximately 320 million euros. Total net sales will grow 15% in 2025, gross margins will be around 52%, and the fourth quarter will be very strong. The financial report performed better than previously expected, and ASML ADR rose more than 3% before the market opened on the 15th, reaching $1,013.96.